Thursday, February 4, 2021

US Shale Outlook 2021: Oil Demand Recovery and Price Forecast

The outlook for US shale is cautiously optimistic with expected improvement on the second half of 2021. Current damage to…

Q2 Technologies Team

Experts in H2S Scavenging Solutions

With decades of combined experience, the Q2 Technologies team specializes in innovative hydrogen sulfide (H2S) scavenging solutions for the oil and gas, wastewater treatment, and industrial sectors.

Reflections on global oil demand/supply for 2021

While 2020 brought a huge shock to the entire world, the oil industry was hit particularly hard. US shale requires continued investment to respond to the future global oil needs. However, as we look back on the past year and move forward with the new year, there are three important factors to consider as we reflect on the outlook for US shale. We expect a general improvement for oil, and for US shale in particular while capital discipline will make it hard to find resources for investment.

Demand Side

Demand destruction during the past year was less than most expected.

Global oil demand only decreased in the mid-teens during the COVID 19 crisis though it was thought that demand would decrease in the high 20’s. Even with reduced economic activity and widespread lock-downs during the current pandemic, global oil demand did not fall as much as it was feared. A part of this is due to the people’s avoidance of public transportation to avoid exposure. This is a particularly interesting phenomenon because it seems to point to a permanent behavioral change resulting from the pandemic. The importance of preserving energy independence if also a key geopolitical point for the US moving forward.

Global oil demand recovery has been very robust.

The lowest global oil demand in April 2020 was close to 80MMbpd and it is currently back at over 100+ MMbpd. This is a very significant increase since mid-April 2020. The demand outlook for 2021 is really strong considering a successful global vaccine rollout. That will bring along strong economic recovery and a comeback of traveling and jet fuel demand.

Supply Side

Global Oil inventories are getting lower and lower.

Global oil and liquids inventories signal the direction of prices. Currently, they are falling and are expected to continue to do so. The initial shut-ins and production curtailments resulting from pandemic reduced global oil supply. While we foresee increased demand, the natural decline in productivity rate will drive supply declines in late 2020 and through 2021. Oil supply coming from OPEC+ is expected to hold flat through 2021 at 3 MMbpd if price remains at $45/bbl.

At strip pricing, the global oil inventory drawdowns will accelerate sharply in the coming months leading to unrealistic inventories. If price remains at $45, crude oil inventories expressed as OECD days of consumption would reach only 22, which signals that prices could not be that low. Inventories are normalized around 30.

Production and price levels are likely to rise.

It is expected to see prices gradually rising during the first half of 2021 while they will rise sharply during the second half considering the inventories falling way beyond normal. OPEC will likely increase production to max capacity by the end of 2021. Additionally, it is expected that Iran will also be able to participate on the market with an additional supply of around 1Mbpd.

US shale response

The outlook for US shale is cautiously optimistic with expected improvement on the second half of 2021. Current damage to US industry will result in substantially low supply during the current year. US supply response will lag rig count changes. For the US to increase production, it is expected that oilfield activity will ramp sharply higher towards the end of 2021 and into 2022 when oil prices reach higher levels.

As production ramps up, operators must focus on controlling costs to remain competitive. Learn how to lower lease operating expenses.

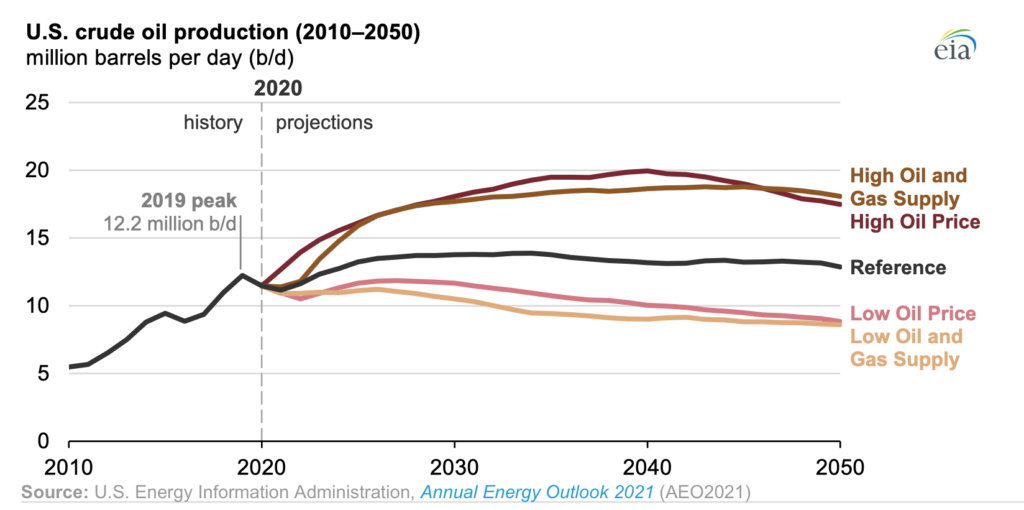

If existing laws and regulations remain through 2050, projects domestic crude oil production to return to 2019 levels by 2023 and then remain near 13 million to 14 million barrels per day (b/d) through 2050. The United States continues to be an integral part of global oil markets and a significant source of supply, despite uncertainty surrounding post-pandemic expectations for oil and natural gas demand.

High H2S and mercaptans levels are expected to continue appearing in the many Permian Basin wells, hence timely monitoring and treatment are paramount even during these next few months when prices are expected to remain around $45. As production levels rise, so will the need for treatment. As always, we at Q2 Technologies are here to serve you with all your treatment needs.

Related Articles

HOW CAN WE HELP?

Have a question? Need a quote? Our technical staff is here to help you identify the right solution for your project requirements.