Thursday, January 3, 2019

Time for WTI-Houston to Become the Global Oil Price Benchmark

While the traditional oil price benchmark has been the Brent crude, oil production in that region has declined whereas the…

Q2 Technologies Team

Experts in H2S Scavenging Solutions

With decades of combined experience, the Q2 Technologies team specializes in innovative hydrogen sulfide (H2S) scavenging solutions for the oil and gas, wastewater treatment, and industrial sectors.

Why is there a difference among oil prices from different regions? Why has the Brent crude been the traditional benchmark?

There is a growing trend from analysts highlighting the decreasing importance of North Sea crude (BFOE) to reflect the true global oil benchmark. Production in the North Sea has been declining as production in the US has boomed. The shale revolution across the United States from West Texas, Eagle Ford and Bakken has pushed the United States to become a net exporter of crude oil. US refiners continue to import heavy crude as the refineries were designed to process heavy crude from Canada, Mexico, Africa, Saudi Arabia and Venezuela. The wave of light sweet crude oil from the national shale plays was unexpected for USGC refiners.

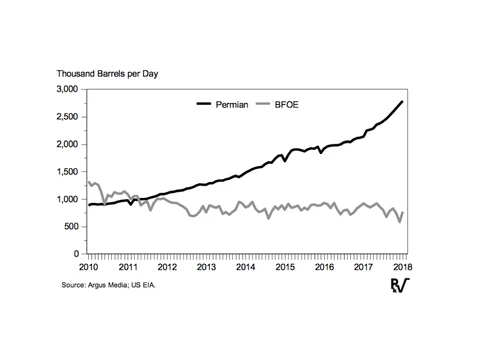

Figure 1: Crude Oil Production from Permian Basin vs. Output from BFOE Market, Monthly Data, 2010 to 2018

Figure 1 shows the dominance of Permian crude production over BFOE production. This figure excludes crude from the Bakken and Eagle Ford that is blended into West Texas Intermediate (WTI) grade crude.

How WTI-Houston Became a Market Leader

The increasing pipeline connectivity from West Texas into the Houston and Corpus Christi ports tied with increased terminal and dock capacity has opened the doors for WTI to be exported across the world and priced on the water. As the crude export ban in the US was lifted, the world markets gained access to an alternative light sweet crude oil that competes directly with Brent. 2018 marked the first year where US crude exports broke the 2 MMb/d mark. The globalization of US produced crude has also begun to highlight some inherent problems and vulnerabilities that the Brent price has compared to WTI.

What Is the WTI-Houston Benchmark?

The WTI-Houston benchmark has been gaining importance as crude exports surge. The Argus, WTI delivered to Houston spot-price assessment was launched in February 2015. The WTI-Houston price is derived from volume-weighted averages of trades during a trading day and are reported to Argus as a differential to the Commodities Mercantile Exchange’s WTI future contracts in Cushing. The price was assessed in the Magellan East Houston terminal that was receiving close to 500,000 bbl/d. The WTI assessment in Houston is now expected to use data from cargoes of more than 1 MMb/d as new pipelines reach capacity. The market for physical trading in the Gulf Coast has been very well connected historically with imports in excess of 3 MMb/d of crude giving way to transparency in trades and pricing. The fact that US producers are not constrained by output limits like OPEC countries has allowed the US to truly become the marginal barrel of oil supplier that impacts global oil markets.

Where WTI-Houston Is Priced and Why It Matters

The WTI Houston price is determined at an export gateway with high liquidity and transparency from pipeline trades compared to the limited liquidity of seaborne cargo markets. The adoption of WTI-Houston pricing would be a significant change in benchmarking history and would acknowledge the importance of US a marginal barrel supplier with market impacts worldwide.

How Q2 Technologies Adds Value to Export Crude

We at Q2 Technologies are here to help American oil producers maximize the value of their barrel before exporting by treating it with our Pro3® non amine scavenger to remove H2S. Contact us to discuss how we can help you.

FAQs

WTI Houston reflects U.S. inland crude oil production and Gulf Coast export pricing, making it more representative of current North American supply and logistics dynamics. Brent, by contrast, is a North Sea benchmark that may no longer reflect global market realities as accurately.

As U.S. exports grow, WTI Houston becomes a more relevant global benchmark, better aligned with the physical flow of oil and refinery preferences. This shift strengthens the role of U.S. crude in international pricing and trade decisions.

Q2 Technologies helps producers meet quality and safety standards for exported crude by offering H2S removal solutions like Pro3®. These treatments ensure that crude meets regulations and minimizes risks during transport, storage, and international delivery.

Related Articles

HOW CAN WE HELP?

Have a question? Need a quote? Our technical staff is here to help you identify the right solution for your project requirements.