The Triazine Market Explainer

Deep Freeze February 2021:

Texas and much of Louisiana experienced an unprecedented extended freeze that shocked nearly every facet of modern living in the region from busted water lines and electrical outages to major industrial systems going offline.

The chemical industry that supports the Oil & Gas industry, especially for Producers that use triazine or other amine-base chemistries to treat hydrocarbons, also felt the effects of this storm. Triazine based chemistries have been traditionally used to scavenge hydrogen sulfide (H2S) from natural gas and certain liquid hydrocarbon streams. The storm and summer have passed, but the long-term ramifications are still playing out, and for some the supply crunch is very much ongoing. Relief is on the horizon but not fast enough for some. Here’s a bit of history as to why we are seeing this near-commodity market acting the way it is and some forecasts for the supply/demand in 2022.

Winter Storm of February 2021

In mid-February 2021, Texas suffered major power outages throughout the state spurred on by a series of winter and ice storms from Feb. 13-17. The storms caused a massive electricity generation failure across Texas which led to shortages of food, water, and heat – all told more than 4.5 million homes and businesses were left without power for days and over $20 billion in damages have been reported.

The Components of Triazine

The formaldehyde-MEA triazine, which is a common H2S scavenger in natural gas, is synthesized by the reaction of formaldehyde and monoethanolamine (MEA). Triazine, water, and free formaldehyde or free MEA are the components of triazine and each play a critical role in the effectiveness of triazine as a stable product. It is a near commodity because of the overall general availability and mass manufacturing in the Gulf.

Why the Supply Upset in late 2021?

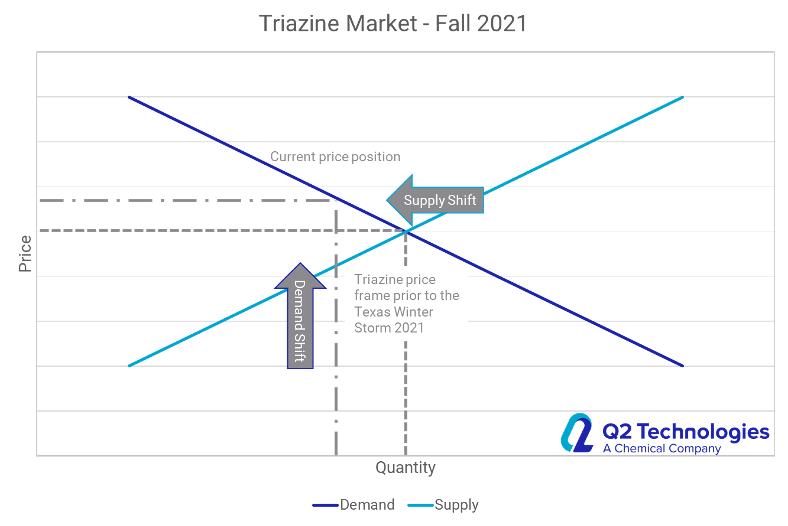

The chemical plants that are devoted to making the raw material for triazine, namely formaldehyde and MEA for the U.S., are located predominately along the Gulf Coast and most were severely impacted by the 2021 Winter Storm. When those plants went down for maintenance under force majeure in late February, some experienced extended delays taking months to get back online. This maintenance period was by far longer than most expected. During this downtime, Producers and other end users partly relied on existing inventory of triazine and began to see tighter allocation of both raw materials. As Q1 and Q2 progressed, MEA prices continued to steadily climb due to tight supply and higher demand in oil & gas as WTI continued to climb. H2S scavenging or H2S removal is needed for safety standards but also due to flaring restrictions in natural gas. It is necessary for Producers to remove H2S before flaring to limit SO2 emissions. If a Producer reaches its flaring limit, the highly valued crude oil value cannot be extracted, and the well must be shut in. Both Texas and New Mexico, where most of U.S. production is found have strict flaring limits.

As plants came back online in the late spring/early summer, the supply of MEA was still tight as manufacturers had drained coastal storage tank inventories. The storage tanks had run so low, there was concern that the tanks needed to be refilled to a certain level to ensure that when Hurricane Season was upon the Gulf Coast, there would be enough volume to physically weigh down the tanks incase high winds took direct aim.

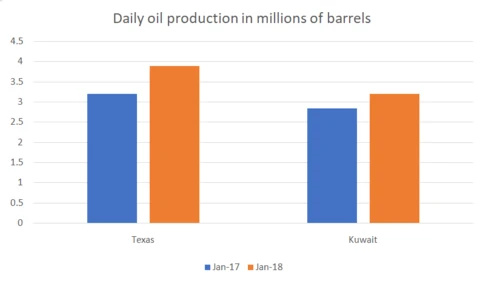

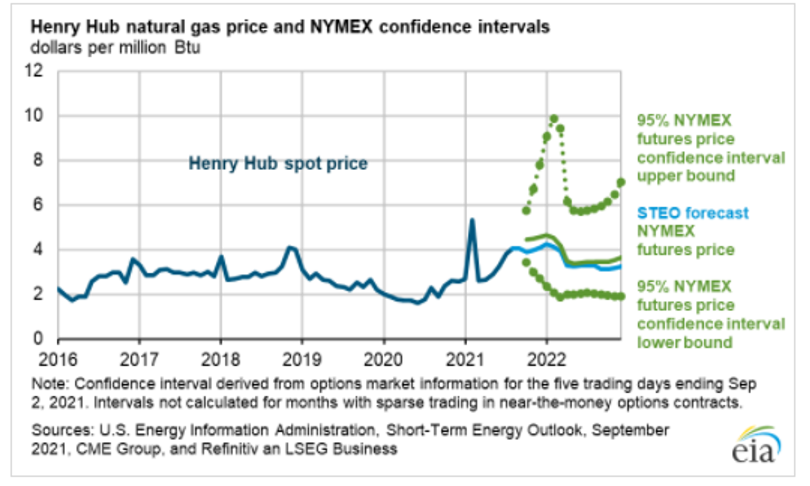

Therefore, even though MEA was being made, the throttle was not fully opened to triazine manufacturers and a supply squeeze, albeit slightly lessened from earlier in the year, was still driving prices higher as demand increased in parallel. As WTI and Brent continue to climb, natural gas has also seen as surge in pricing. Natural gas prices that had been hovering around $2.50/MMBtu has spiked to $5.95/MMBtu on 9/28/21. Associated gas from crude oil production typically seen with little no value now warrants higher H2S treatment costs which drive triazine demand higher.

Near-term Henry Hub gas prices still support elevated levels of $/MMBtu which provides a bit of netback cushion to absorb the cost of treating with triazine. However, as triazine prices will fall when supply is rebalanced, the cost to treat the gas could improve the Producers’ netback price for gas.

Outlook for Triazine

Hurricane Ida played an important role in the current amine shortage. The two largest producers lost about two weeks of production and declared force majeure limiting their supply to about 50% of normal output. A Mexican manufacturer is also down for maintenance leaving only one supplier running at capacity. Ethanolamine manufacturers are seeing 2-3x demand higher than production and see the shortage lasting well into 2022.

With the uncertainty of the supply of triazine in the market, as a manufacturer and supplier of triazine, we understand the market’s frustration! However, if your production has been severely impacted by triazine and if you are using that to treat crude oil or liquids, our Pro Series (Pro3® and ProM®) line of non-triazine/non-amine scavengers could be a cost and operational savings an alternative. Contact us at Sales@Q2Tehnologies.com or 832-328-2200 to learn more about how we are treating millions of barrels each month with these products.

Sources:

https://www.noaa.gov/news-release/noaa-predicts-another-active-atlantic-hurricane-season.

https://www.eia.gov/naturalgas/weekly/#tabs-prices-2.

Q2 Technologies company data, 2001-2021, https://q2technologies.com/.

Related Articles

Q2 Technologies will be sponsoring the registration process of the 2017 Midstream Texas

April 18, 2017

The Port of Corpus Christi Expands Infrastructure to Support Oil Exports

April 04, 2018

See you June 5-6 in the Midstream Texas Conference in Midland!

June 05, 2018