Friday, February 15, 2019

The oil industry in perspective: A brief review of the Argus Americas Crude Summit

There are four key takeaways regarding the Argus Americas Crude Oil Summit that will help you make more informed decisions…

Q2 Technologies Team

Experts in H2S Scavenging Solutions

With decades of combined experience, the Q2 Technologies team specializes in innovative hydrogen sulfide (H2S) scavenging solutions for the oil and gas, wastewater treatment, and industrial sectors.

If you are an active participant in the oil industry, it is highly likely that you attended the Argus Americas Crude Summit Jan 22-24th. and that we had a chance to catch up. However, it is always convenient to stop and think about what we learned at a conference. Whether you were there or you missed it this time, there are four key ideas that will be helpful for us all as 2019 continues to evolve:

Regarding the production of oil in the US and its role as an exporter

It is well known by now that the nation has become a major player in oil production and export. What is new? Though China did stop buying US oil, exports continue to grow as seen on Figure 1 and new markets in South Asia are being developed. This area is where most new oil demand will be located.

Figure 1

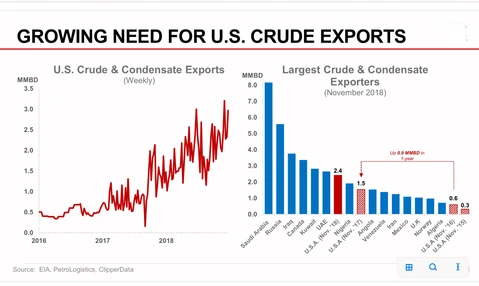

Regarding the pipeline network in America

Regarding the infrastructure challenges faced by US producers to reach the market, there have been great advances. The bottle necks that kept prices down for WTI have mostly been removed and the continued expansion of the pipeline network has brought more players, more competition and new opportunities. Some of the new developments are the building of offshore oil loading terminals and the adaptation of facilities to serve supertankers. This is needed as pipelines from the Permian Basin and Eagle Ford Shale are nearing completion to move record amounts of crude oil and natural gas liquids to destinations along the Gulf Coast. Figure 2 shows the existing Gas Transmission and Hazardous Liquid Pipelines in the US, as can be seen, there is an extensive network which will continue to grow and adapt to market needs.

Figure 2

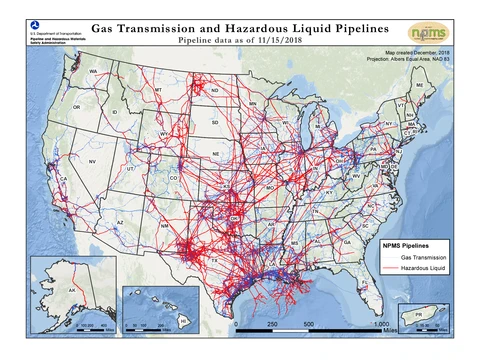

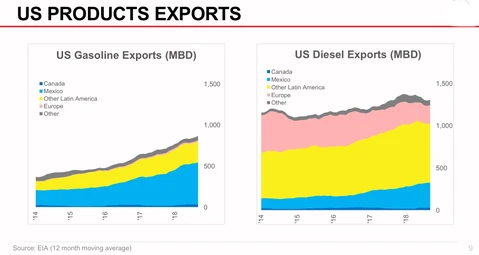

Regarding US refining capacity

There are important MARPOL VI implications for oil markets, mostly disruptions in the market, though most US refiner margins will improve. However, sour products and crudes will fall in value. Q2 Technologies can help sour crude producers to increase the value of their barrel with the Pro3® non amine H2S scavenger. In addition, US refined products export growth is expected to continue. Mexico and the rest of Latin America have increased their demand of US gasoline and diesel as you can see in Figure 3.

Figure 3

Regarding volatility drivers

It is important to consider the expectations in the current climate of instability within the US and elsewhere. The trade tensions with China, the instability and risks in Venezuela, and the power balance with Russia, another key worldwide oil exporter who has acquired a larger role in the geopolitical arena, bring uncertainty. Similarly, the glitches in developing infrastructure in the US, the governmental and regulatory possibilities, as well as the potential slowing global growth contribute to the wealth of variables that impact the oil industry. With so many variables, it continues to be valuable to attend to events like the Argus Americas Crude Summit to gain insight and better plan our own business strategies.

Let’s Talk: Improve the Value of Your Barrel

Contact us to discuss how we can help you navigate current times increasing the value of your barrel.

FAQs

Q2 Technologies provides specialized chemical solutions that help oil and gas operators meet environmental regulations, improve product quality, and optimize operations. Our H2S and mercaptan scavengers play a critical role in emissions reduction and fuel compliance, especially in the context of increasingly strict sulfur content standards.

Industry summits offer valuable insight into market trends, regulatory changes, and future pricing outlooks. They also provide networking opportunities with decision-makers and thought leaders. For businesses like Q2, these events help us stay ahead of industry needs and align our innovations with evolving market demands.

MARPOL Annex VI sets strict limits on sulfur emissions from marine fuels, pushing refiners and producers to develop and supply low-sulfur alternatives. This regulation has reshaped global demand and refining strategies. Q2 supports the industry’s compliance efforts by offering advanced scavenging technologies to reduce sulfur content efficiently and reliably.

Related Articles

HOW CAN WE HELP?

Have a question? Need a quote? Our technical staff is here to help you identify the right solution for your project requirements.