Thursday, June 21, 2018

Why Chinese tariffs on US oil are a concern

The Chinese oil market is important for US oil exports as new refining capacity is being installed to reach 16…

Q2 Technologies Team

Experts in H2S Scavenging Solutions

With decades of combined experience, the Q2 Technologies team specializes in innovative hydrogen sulfide (H2S) scavenging solutions for the oil and gas, wastewater treatment, and industrial sectors.

What Is the Importance of China in the US Oil Market?

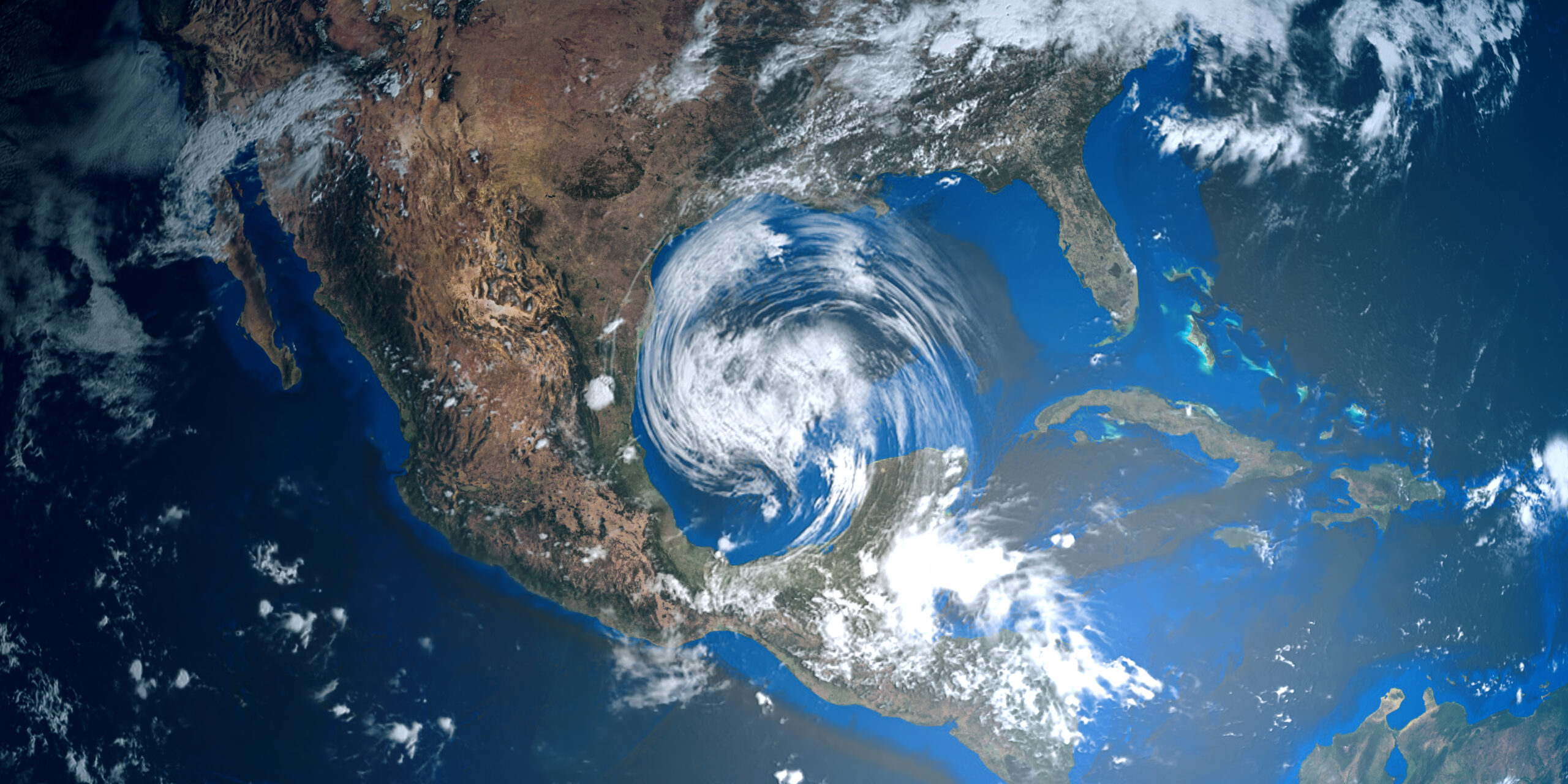

China will increasingly become the destination of US oil exports. China, India and the rest of Asia are home to virtually all the anticipated growth in global oil demand. China is the largest customer for U.S. crude, importing about 363,000 barrels per day (bbl/d) in the six months ended in March. Thomson Reuters shipping data shows those exports have increased since, rising to an expected 450,000 bbl/d in July.

Why Is Chinese Demand for Oil Increasing Rapidly?

While there is a lot of hype about the US becoming an oil exporter, there has been less discussion about the importance of China as a market. China’s economic growth is well known. In order to satisfy the needs of its economy as it continues to develop, China is preparing itself with refining and petrochemical capabilities. However, the Chinese need to import the oil required to feed these plants. More than 3 million barrels per day new refining capacity is being installed between 2017 and 2020 in China, mostly by independent refiners meaning that by 2020 China will have a 16 million bbl/d refining capacity. In contrast, the refining capacity in the US in 2017 was 18 million bbl/d, having increased only slightly in the last year.

It is important to maximize the value of your barrel before exporting your oil by treating it with our Pro3® non-amine scavenger to remove H2S. Contact us to discuss how we can help you.

How Would Chinese Tariffs Impact US Shale Oil Exports?

Geopolitical considerations weigh in future outcomes for oil exporters in the short term and in the long run. US shale producers are starting to respond to China’s threat to impose a 25% tariff on crude, natural gas and coal starting on July 6, 2018, in retaliation for the Trump administrations planned tariff on Chinese goods. The tariff would hurt everyone in the short term, but U.S. crude will continue to flow to market even with tariffs, though prices could be hurt. We at Q2 Technologies are deeply concerned for the implications of these possibilities and hope that the trade dispute between the two countries is resolved quickly.

What Are the Broader Global Implications?

Furthermore, it will be interesting to take notice of how current suppliers in the Middle East, Russia and elsewhere respond to the Chinese market opportunity. Similarly, for Americans and for any country interested in the American market, it will also be relevant to consider the implications of the recently established American embargo on Iran given that it is an oil supplier on one hand, and a potential client on the other. Similarly, for Americans and for any country interested in the American market, it will also be relevant to consider the implications of the recently established American embargo on Iran given that it is an oil supplier on one hand, and a potential client on the other. Read how Mexico plans to import sweet crude oil in November.

Dr. Laura Resendez from Rice and Beans Culture

Dr. Laura Resendez from Rice and Beans Culture

FAQs

The Chinese government imposed a 25% tariff on U.S. crude oil imports as part of the ongoing trade tensions between the two countries. This additional cost makes American oil less competitive in the Chinese market compared to other global suppliers, reducing demand for U.S. exports.

China is one of the world’s largest oil importers, so its demand plays a major role in shaping global crude flows. When Chinese buyers reduce imports of U.S. oil due to tariffs or policy changes, it creates ripple effects across the global market—impacting U.S. producers, pricing dynamics, and trade balances.

Before the tariff-related disruptions, China was among the top destinations for U.S. crude, at times importing over 300,000 barrels per day. However, trade tensions and tariffs have significantly reduced these volumes, prompting U.S. producers to seek alternative markets for their supply.

Related Articles

HOW CAN WE HELP?

Have a question? Need a quote? Our technical staff is here to help you identify the right solution for your project requirements.