If you are an active participant in the oil industry, it is highly likely that you attended the Argus Americas Crude Summit Jan 22-24th. and that we had a chance to catch up. However, it is always convenient to stop and think about what we learned at a conference. Whether you were there or you missed it this time, there are four key ideas that will be helpful for us all as 2019 continues to evolve:

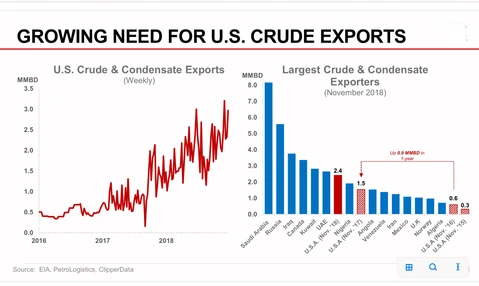

Regarding the production of oil in the US and its role as an exporter

It is well known by now that the nation has become a major player in oil production and export. What is new? Though China did stop buying US oil, exports continue to grow as seen on Figure 1 and new markets in South Asia are being developed. This area is where most new oil demand will be located.

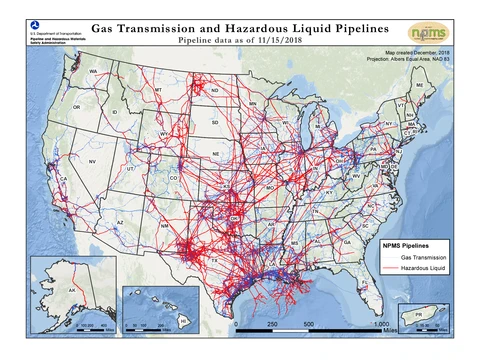

Regarding the pipeline network in America

Figure 2

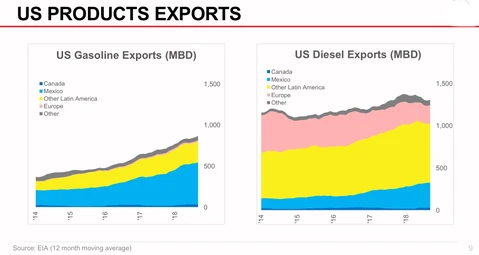

Regarding US refining capacity

There are important MARPOL VI implications for oil markets, mostly disruptions in the market, though most US refiner margins will improve. However, sour products and crudes will fall in value. Q2 Technologies can help sour crude producers to increase the value of their barrel with the Pro3® non amine H2S scavenger. In addition, US refined products export growth is expected to continue. Mexico and the rest of Latin America have increased their demand of US gasoline and diesel as you can see in Figure 3.

Figure 3

Regarding volatility drivers

It is important to consider the expectations in the current climate of instability within the US and elsewhere. The trade tensions with China, the instability and risks in Venezuela, and the power balance with Russia, another key worldwide oil exporter who has acquired a larger role in the geopolitical arena, bring uncertainty. Similarly, the glitches in developing infrastructure in the US, the governmental and regulatory possibilities, as well as the potential slowing global growth contribute to the wealth of variables that impact the oil industry. With so many variables, it continues to be valuable to attend to events like the Argus Americas Crude Summit to gain insight and better plan our own business strategies.