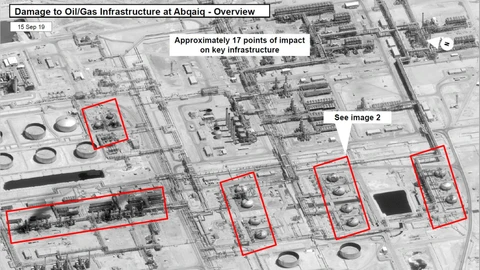

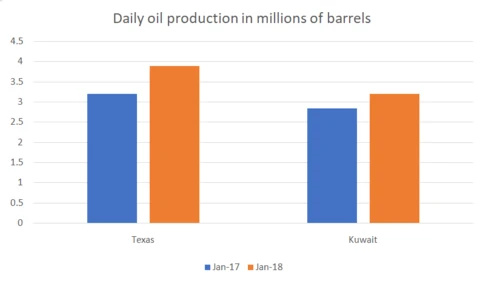

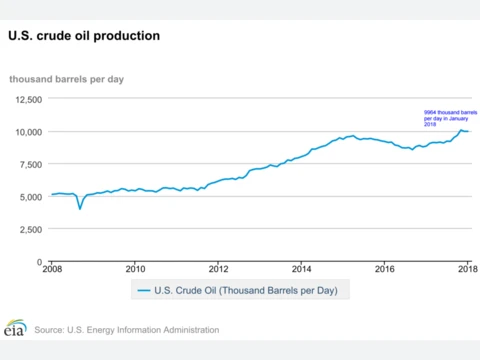

A result of lost capacity in Saudi Arabia

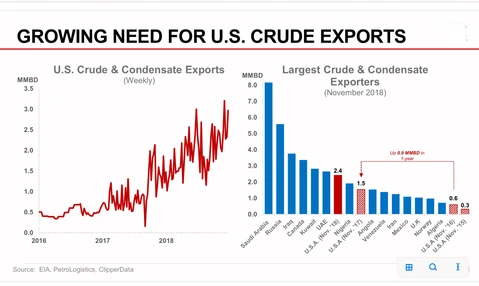

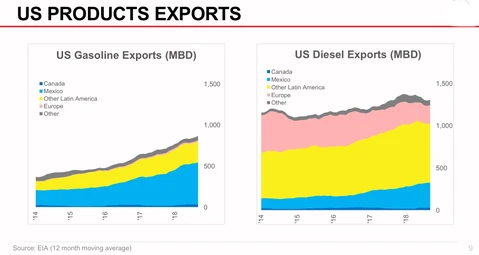

Chartering of very large crude carriers, or VLCCs, to ferry oil from the US Gulf Coast to Asia has increased $5 a barrel. This is about twice the price before the attacks in Saudi Arabia. The increase has raised the price of US oil sold overseas at a time when Japan, South Korea and India are replacing the lost deliveries from Saudi Arabia and increasing their stockpiles to buffer against further supply disruptions.

Added tanker shortage by retrofitting ships

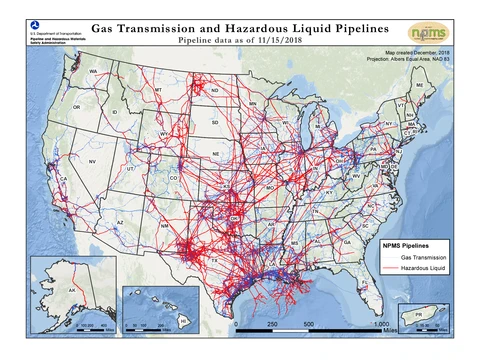

Timing for the increased US oil demand is being further complicated. The heightened tanker demand is meeting a shortage of available ships given that many are in harbor being retrofitted to comply with new international emission standards that will go into effect in 2020. The higher transport cost of US oil threatens to send buyers elsewhere, reducing US crude exports.

US crude exports at risk

A tanker at the Port of Corpus Christi, Texas. The cost of chartering a tanker to ship crude across the ocean has continued to soar after the attacks in Saudi Arabia. PHOTO: EDDIE SEAL/BLOOMBERG NEWS

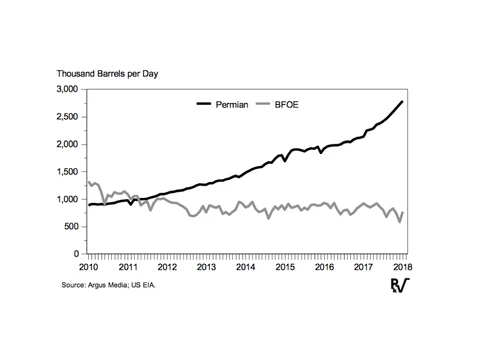

Why High Shipping Costs Hurt Domestic Crude Producers Most

South Korea has been the largest buyer, importing 605,000 barrels a day from the US. This is 20% of all US crude exports. The increased shipping costs could really hurt domestic drillers already facing lower prices while buyers such as South Korea diversify to buy oil from the North Sea, West Africa and Brazil. Michael Tran, an analyst with RBC Capital Markets said: “If it becomes uneconomical to ship US barrels to Asia, that essentially leaves barrels stranded in the US.”