Thursday, November 4, 2021

Treating Trucked Sour Crude

Barrels that have moderate to high levels of H2S are typically challenged economically from the start. Q2 Technologies recently implemented…

Q2 Technologies Team

Experts in H2S Scavenging Solutions

With decades of combined experience, the Q2 Technologies team specializes in innovative hydrogen sulfide (H2S) scavenging solutions for the oil and gas, wastewater treatment, and industrial sectors.

Unique Treatment Solutions

Barrels that have moderate to high levels of H2S are typically challenged economically from the start. First, from a safety standpoint – more oversight, training, CAPEX & OPEX, and effort goes into protecting the people and assets involved. Next, the untreated barrel will likely get rejected commercially and will not move via pipeline, which leaves trucking that sour barrel to market as the only alternative. Unfortunately, as a double whammy, that trucked sour barrel typically goes to a market that stacks yet another financial hardship on its value: a dreaded sour oil deduct on the netback price. The value erosion on that barrel can be a significant drain on the Producer, and in some plays the whittling away on the sour barrel can be borderline uneconomic. Ugh!

Trucking as a Lifeline for Stranded Sour Crude

With higher overall WTI per barrel in Q4 2021, more production is likely on the way to realize the price bump. In fact, production in the Permian is heading back to pre-pandemic levels increasing output to an average of 4.826mmbls/d in October, according to a recent ClusterX article citing a U.S. government report. Which is just shy of the record set in March 2020 at 4.913mmbbls/d right before COVID-19 fundamentally disrupted global demand and sent supply reeling. Although the industry has done a good job in the previous years building out the gathering and long-haul pipeline systems, trucking fills in the gaps. Although difficult to pin down an exact number, trucking in the Permian has always filled the takeaway gap and according to several historical reports, several thousand truck haulers operator daily – which means potentially a quarter million+ barrels are being hauled in the Permian at any given time. And in this case for sour barrels, Producers and Midstreamers rely heavily on this critical delivery component. It can be challenging to commit capital to build pipelines to inherently less valued barrels due to the presence of their sulfur content, and so, many sour barrels are stranded in the field to be delivered only by truck.

An Innovative Approach to Treating Trucked Sour Crude

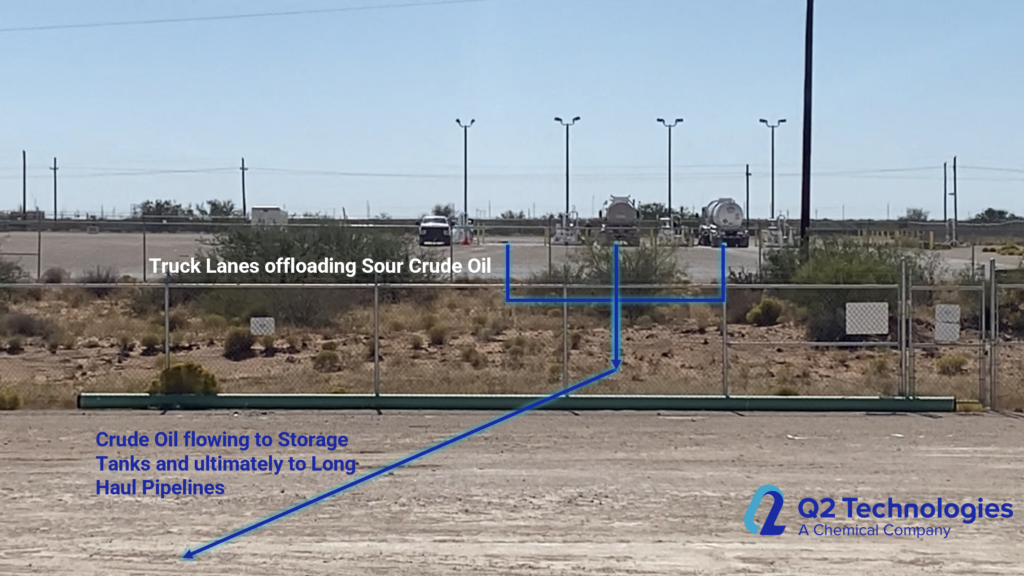

Fortunately, there are treatment solutions available, and economic ones a that! Q2 Technologies recently implemented a system for a leading Midstream company to accept H2S barrels to treat automatically at an existing multi truck lane LACT station. This novel approach makes economic sense to all parties involved; here’s how it works:

How the System Works: Automated H2S Removal at LACT

Once the oil hauler, who is transporting a sour barrel, begins pumping volume at the facility, the lease automatic custody transfer (LACT) sends a signal to the Q2 pumps to being dosing. The crude oil is then treated as it is transferred in the tanks. Once treated, the barrel meets H2S specifications and can be sold into a sweet market. This setup is capable of treating all lanes simultaneously several thousand barrels per day at H2S levels in tens of thousands of ppm.

Benefits for Producers, Haulers, and Midstream Companies

Producers are able to produce their sour barrel and deliver it to a facility that is tied into one of the premier markets in the Permian, in order to fetch the highest netback prices available. Oil haulers are staying busy moving product to market. The Midstream company did not have to reject that sour barrel, thus increasing throughput and generating additional revenue. A win-win-win!

High-Volume Treatment Without Disruption

The comingled lines are routed to a single point where treatment occurs. Oil Haulers transport approximately 190bbls per load, and this facility receives several dozen loads per day of H2S ladened crude oil.

As the crude oil flows towards the tank battery, Q2’s Pro3 product is injected, thus ensuring that treated volume enters the tank battery array. This configuration allows for all truck lanes to offload and be treated simultaneously without pressure or flow upsets.

Sources:

https://content.clusterx.com/articles/1018-oil-production-permian-shale-nearing-pre-pandemic-levels

https://www.eia.gov/dnav/pet/pet_pnp_caprec_dcu_r30_a.htm

https://www.marketwatch.com/investing/future/crude%20oil%20-%20electronic

Q2 Technologies company data, 2001-2021.

FAQs

Q2 Technologies uses specialized chemical scavengers designed to neutralize hydrogen sulfide (H2S) directly at the loading site or during transport. This treatment reduces H2S levels safely and efficiently, ensuring the crude meets quality and safety standards.

Yes, by lowering H2S content through treatment, sour crude can meet market specifications more easily, expanding access to a wider range of buyers and potentially increasing its value.

On-site treatment provides immediate H2S reduction, improving safety for personnel, preventing equipment corrosion, and ensuring compliance with regulations before crude is transferred or transported.

Related Articles

HOW CAN WE HELP?

Have a question? Need a quote? Our technical staff is here to help you identify the right solution for your project requirements.