Q2 Technologies in the News

Q2 Technologies’ recent announcement is making the rounds as seen on Cison PR Newswire, Market Watch, Seeking Alpha, Yahoo! Finance, and many local news outlets.

HOUSTON and MIDLAND, Texas, Nov. 16, 2021

Q2 Technologies, a specialized chemical company, adds Ever Chavez as Manager of Field Operations to their growing team. Hugo Lozano Jr, VP and General Manager of Q2 Technologies said, “Ever brings tremendous experience and leadership in technical and operational chemical blending from his background at Tech Management and Baker Hughes. We are excited to have Ever on board to develop our growing chemical treatment business in the Permian and beyond.”

Ever’s Background

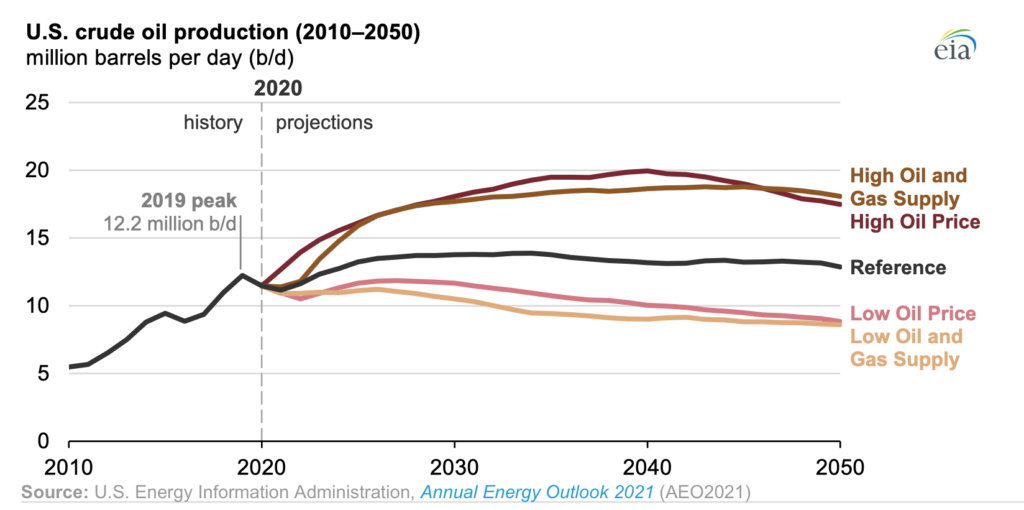

Chavez brings over ten years of chemical process and control engineering experience in the Upstream and Midstream business. His responsibilities will be to grow the established chemical treatment and blending operation Q2 Technologies has established in the Permian Basin, service Q2’s growing customer base, and continue to build the specialized product offerings Q2 provides to other multiple locations.Prior to joining Q2 Technologies, Chavez was with Tech Management. His increasing responsibilities allowed him to focus on overseeing QA/QC testing of product blends. This way, he ensured each product met appropriate standards and measures. Additionally, he has valuable experience in water analysis, chemical compatibility testing, friction flow loop analysis, emulsion testing, and other hydrocarbons specific testing methods. Further, Chavez spent over four years with Baker Hughes in Midland, Texas in account management where he focused on the technical aspects of growing, evaluating, and processing large-scale customer orders. “This is such an exciting time at Q2 Technologies, I’m excited to take on the responsibility to build the established footprint the company has built and take it to the next level. The proprietary and triazine/amine-based suite of products Q2 provides is a significant advantage and I look forward to ensuring that these products are manufactured, delivered, and administered to the highest qualities for our customers,” said Chavez, who holds a B.A. in Industrial Engineering and MBA from the University of Texas at El Paso.

Continuously working to create value for customers

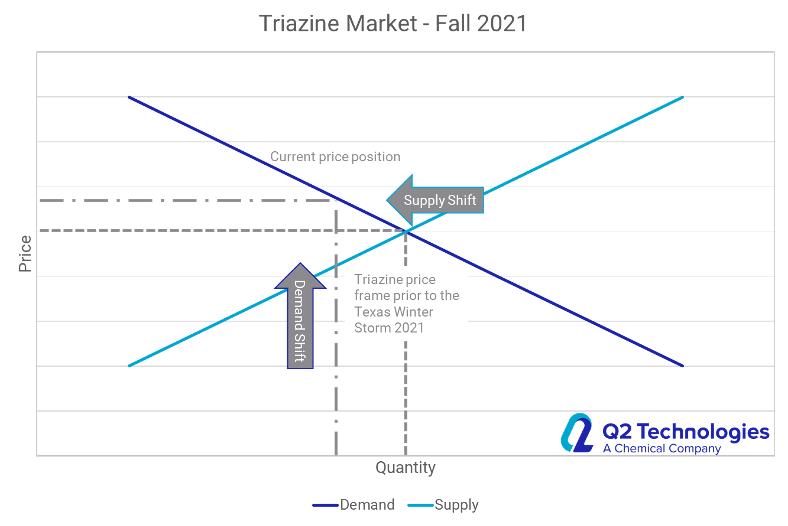

Chavez’s business development acumen and insight will be an additional resource for Q2 Technologies. “Ever has a great blend of technical, commercial, and economic experience in the Oil & Gas industry specially as it pertains to the chemical and treatment aspects,” added Philip Weigand, Vice President of Business Development for Q2 Technologies, “and I am thrilled to have him on the team to continue what we have started: creating value for our customers by treating H2S and mercaptans.”

About Q2 Technologies, LLC

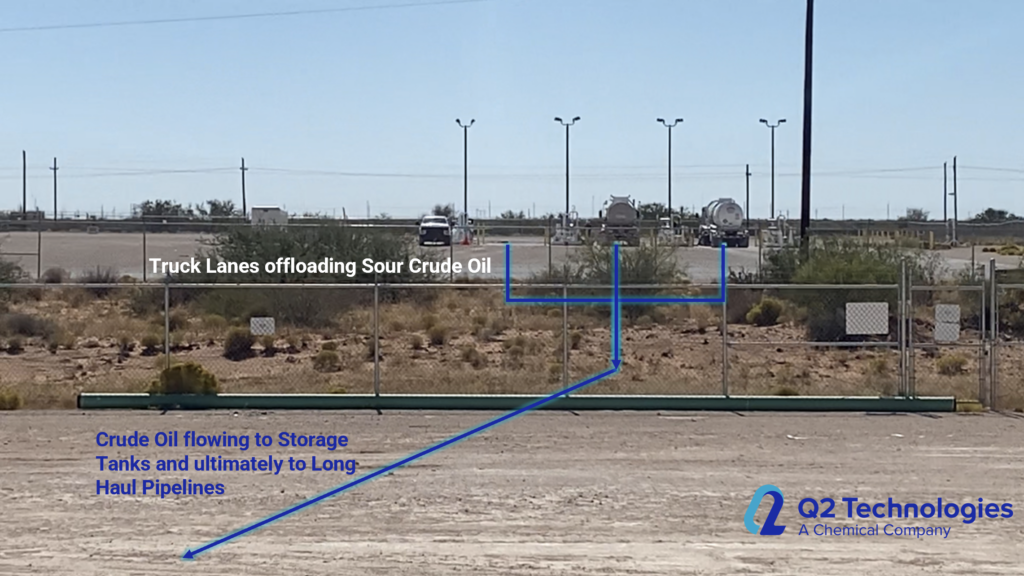

Q2 Technologies specializes in increasing the value of crude oil barrels by offering several solutions: Pro3® line of non-triazine H2S scavengers and ProM® line of non-triazine mercaptan scavengers for crude oil applications. The Pro3® /ProM® technologies currently treat over 6 million barrels of crude oil and condensate each month at major pipelines and terminals in the US. For more information, contact Philip Weigand at 323753@email4pr.com or +1 (832) 328-2200.Q2 Technologies has been in business for over 20 years. The company is a spin-off of Quaker Chemical (NYSE: KWR) and developed the MEA-Triazine scavengers used world-wide today in the late 1980’s. Q2 Technologies is an expert in H2S and mercaptan removal solutions. Q2 Technologies has H2S and mercaptan removal experience in the oil & gas, pulp & paper, wastewater, and landfill gas industries. By combining its experience and research and development within these industries, Q2 Technologies offers superior engineering, application, and chemical solutions.