What Are the Current Global Oil Market Trends?

What’s Causing the Slowdown in Oil Demand?

The pre-pandemic days of explosive oil demand growth are fading. While demand is still expected to increase in 2025 (by an estimated 1.3 million barrels per day), this falls short of both the historical average and the rebound seen post-pandemic. This slowdown is attributed to several factors, including:

- Reduced pent-up demand: The initial surge after pandemic restrictions has subsided.

- Slower global economic growth: Economic conditions are not as robust as in previous years.

- Clean energy adoption: The rise of electric vehicles and other renewable energy sources is impacting oil consumption.

- China’s shifting energy landscape: The adoption of electric and hybrid vehicles, increasing use of LNG trucks, and weak industrial growth in China are further contributing to the slowdown.

Why Is Oil Supply Increasing Despite Lower Demand?

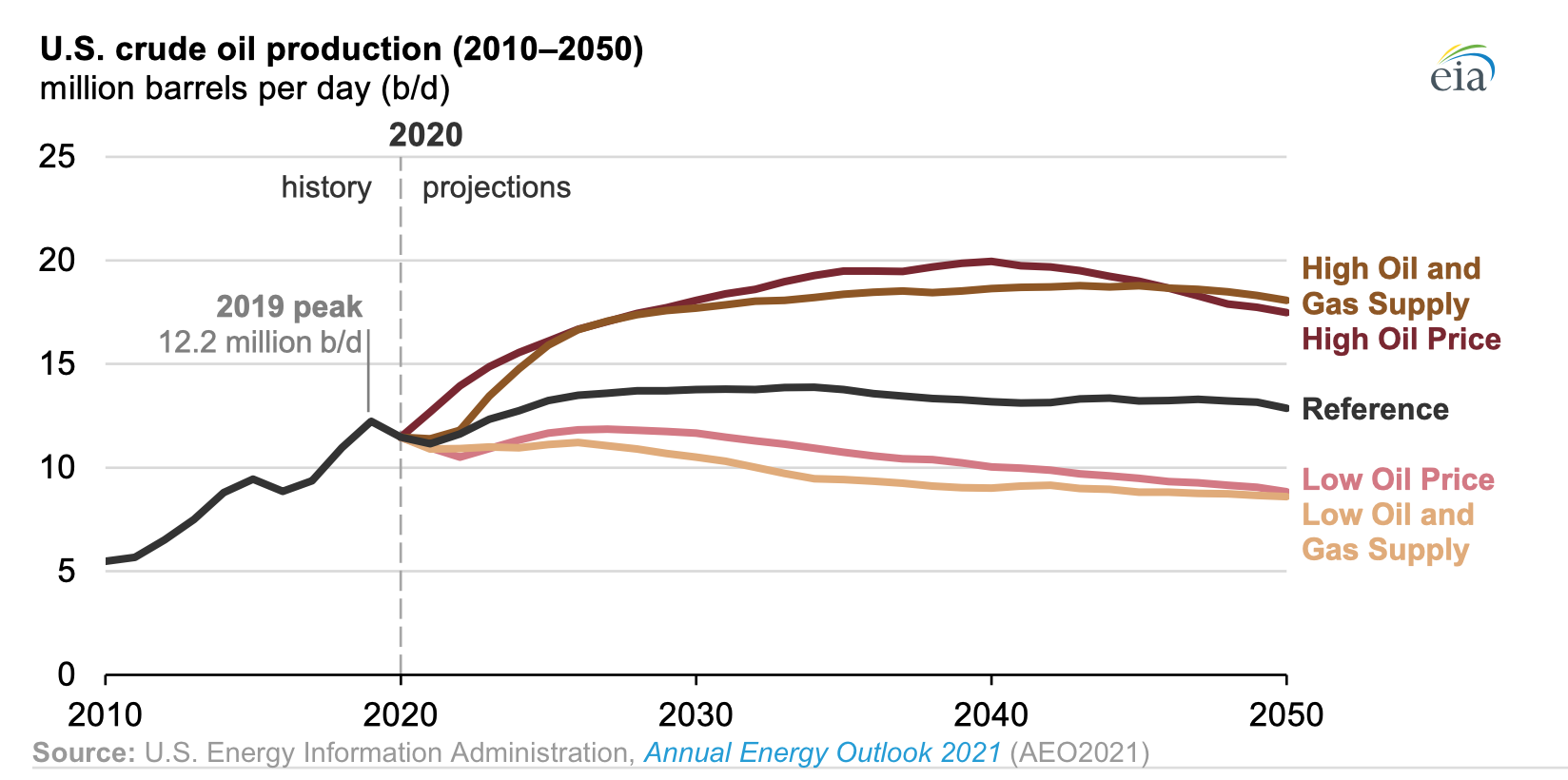

Despite the demand slowdown, global oil production is anticipated to rise by 1.6 million barrels per day in 2025. This increase is primarily driven by production gains in advanced economies and Latin America and the Caribbean. This shift in the production landscape, with non-OPEC+ countries playing a larger role, could lead to a significant oil surplus in 2025, potentially exceeding 1.2 million barrels per day. This surplus, combined with high spare capacity, could put downward pressure on oil prices. While geopolitical tensions in the Middle East could temporarily spike prices, a full unwinding of OPEC+ production cuts could lead to a significant price decline.

Closer to Home

- US Natural Gas Storage: Well-positioned for winter

The good news for US consumers is that natural gas storage is forecast to remain above the five-year average (2019-2023) throughout the winter heating season. In fact, current natural gas injections into storage are the highest since 2016. This indicates a well-supplied market heading into the colder months.

- US Natural Gas Prices: Potential Winter Increas

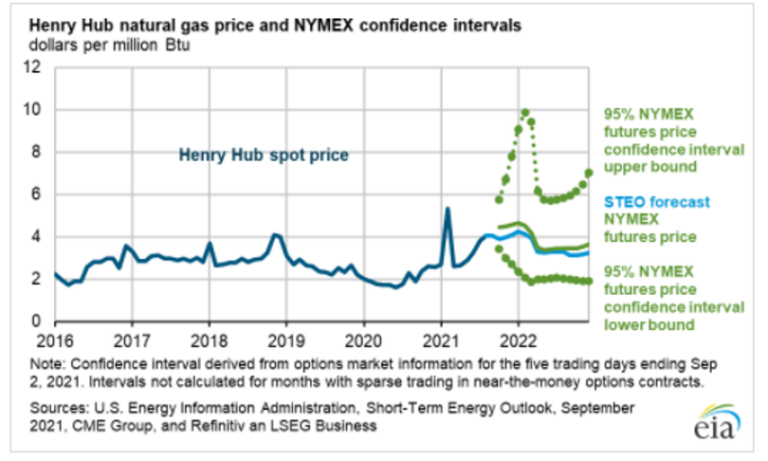

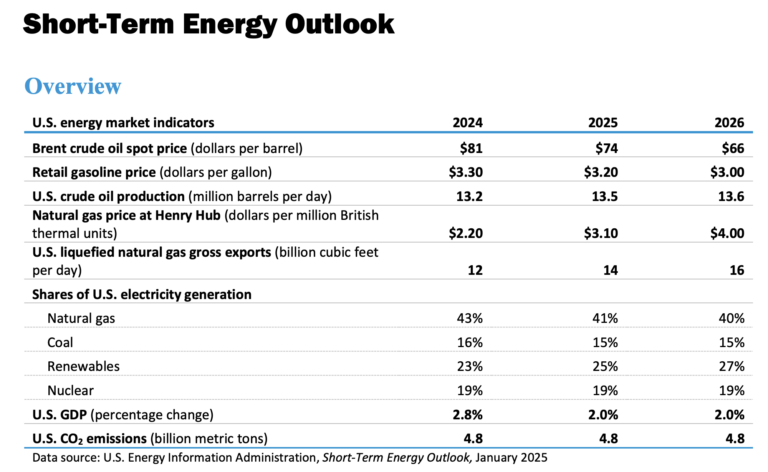

While ample storage provides some comfort, it’s important to note that this surplus is expected to shrink naturally as winter progresses. This could lead to a price increase for Henry Hub natural gas, potentially rising from $2.00/BTU to $3.00/BTU. This price hike could last until spring 2025.

- US Electricity Consumption: Winter drives demand

Residential electricity consumption is directly tied to weather patterns. The EIA forecasts a potential 3% increase in usage this winter compared to last year. Although the early part of the season saw mild temperatures in November, the overall expectation is for a colder winter. This increase in demand, coupled with a potential decrease in natural gas storage, could contribute to the anticipated price rise.

What Is the Role of Artificial Intelligence in Oil and Gas?

Major Trends to look for in 2025 for Oil and Gas

- Predictive Maintenance: AI-powered systems can analyze input and output data from machinery and other equipment to predict potential failures before they occur. This proactive approach extends equipment life and reduces the need for costly replacements.

- Enhanced Exploration: AI can analyze massive datasets of geological data, leading to more efficient and successful exploration efforts. This reduces the risk of dry holes and optimizes resource allocation.

- Production Optimization: AI algorithms can optimize drilling operations, monitor reservoir conditions, and adjust production parameters in real-time. This leads to increased production, reduced energy consumption, and improved resource recovery.

- Reduced Emissions: AI can enhance safety by monitoring equipment, detecting anomalies, and alerting operators to potential hazards. Additionally, it can help optimize energy consumption, reduce emissions, and improve overall environmental performance.

The Future of AI in Oil and Gas

As AI technology continues to advance, its potential applications in the oil and gas industry are vast. Future developments may include:

- Autonomous Operations: AI-powered systems could enable autonomous drilling and production operations, reducing human intervention and increasing efficiency.

- Advanced Analytics: AI can provide deeper insights into complex data, enabling more informed decision-making and optimizing operations.

- Enhanced Sustainability: AI can help identify opportunities to reduce carbon emissions, improve energy efficiency, and promote sustainable practices.

Looking beyond 2025, the role of AI in the oil and gas industry is only expected to grow.

What Is the Impact of IoT on Oil and Gas Logistics?

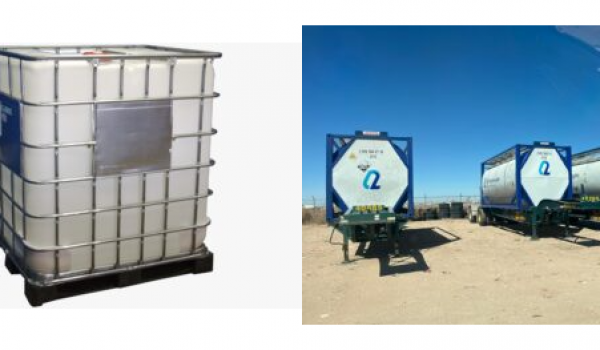

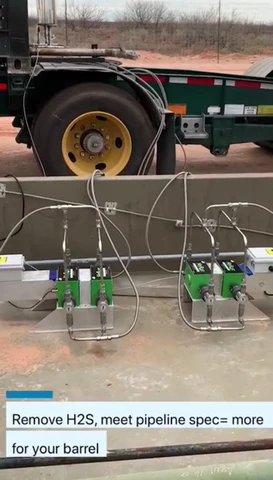

As a leading chemical manufacturer and provider of products designed to treat H2S, mercaptan, and sulfur-based contaminants, we recognize the transformative power of technology. Our focus for Q2 2025 is to further innovate our distribution network by leveraging the Internet of Things (IoT). This powerful network of connected devices offers significant advantages for optimizing supply chains, improving efficiency, and enhancing customer satisfaction.

Key Benefits of IoT in Logistics:

- Enhanced Safety and Security: IoT devices can monitor vehicle performance, driver behavior, and environmental conditions in real-time, ensuring safe and secure point-to-point delivery. Tamper-proof sensors on storage vessels can be monitored to protect product integrity.

- Improved Inventory Management: IoT sensors can track product shelf life, manufacturing dates, and inventory levels, optimizing warehousing efficiency and minimizing waste.

- Streamlined Logistics: By analyzing data from various sources, including traffic conditions, weather forecasts, and delivery schedules, IoT can optimize route planning, de-bottleneck manufacturing processes, and ensure on-time deliveries.

- Real-time Visibility: IoT provides real-time tracking of shipments, allowing for proactive monitoring and timely resolution of any issues.

- Cost Reduction: IoT-enabled optimization of logistics operations can lead to reduced costs through improved efficiency, reduced waste, and minimized downtime.

Final Thoughts: How Is Q2 Technologies Preparing for 2025?

As we begin 2025, the oil and gas industry is poised for a year of both challenges and opportunities. Slower demand growth, increasing supply, and advancements in technology like AI and IoT are reshaping the energy landscape. While uncertainties remain, proactive strategies and innovative solutions will be critical for navigating the road ahead.

At Q2, we’re not just observing these trends—we’re leveraging them. With a steadfast commitment to innovation, operational excellence, and sustainability, we’re ready to meet the demands of a dynamic energy market. Whether through advanced H2S treatment technologies or smarter logistics powered by IoT, we’re prepared to deliver solutions that drive efficiency and value.

2025 is here, and at Q2, we’re ready to embrace it. To learn about our proactive response to the potential dock worker strike and how it may affect supply chains, check out the details here. Also, explore why it might be the time for WTI Houston to become the global oil price benchmark.

Sources:

https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf

https://blogs.worldbank.org/en/opendata/growing-oil-supplies-amid-moderating-demand-and-geopolitical-unc#:~:text=Global%20oil%20demand%20growth%20continues,liquefied%20natural%20gas%20(LNG)

https://www.eia.gov/todayinenergy/detail.php?id=63864

https://moontechnolabs.com/blog/ai-in-oil-and-gas/

https://www.datategy.net/2024/01/09/ai-in-oil-exploration-maximizing-discoveries-minimizing-costs/